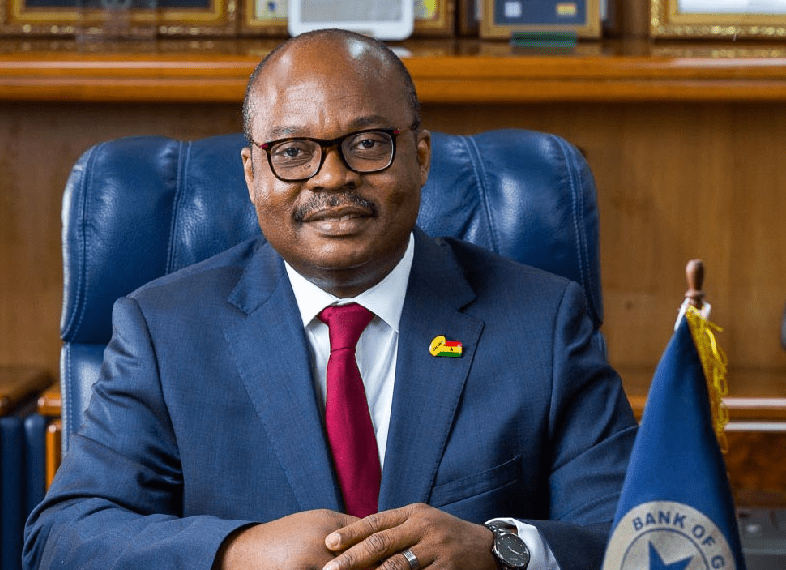

Dr Ernest Addison, the Governor of the Bank of Ghana, has given a keynote speech on the importance of mobile interoperability for financial inclusion and intra-Africa trade at the ongoing African Prosperity Dialogue, summit at the Peduase Lodge in the Eastern region.

According to Dr Addison, the topic is timely and relevant, as Africa needs to embrace the technological progress and innovation that enable different systems and technologies to communicate seamlessly with each other. He said that mobile money platforms have been deployed by several African countries and are making a strong push for interoperability to deepen financial inclusion.

He said that the panel discussion, which featured experts and stakeholders from various sectors, would provide valuable insights and recommendations on how to shape the trajectory of mobile interoperability, influence policymaking, and inspire the development of solutions that transcend boundaries.

He said that the evolution of payment systems across emerging countries has rapidly changed financial transactions and that Africa has been a global leader in mobile money transfer services, according to the IMF. He said that mobile money has revolutionized the way Africans manage their finances, especially among the unbanked, and has integrated into broader payment infrastructures, such as national switches, to enhance interoperability.

He said that mobile money has proven to be pivotal in fostering financial inclusion and that a significant push should be made to enhance mobile interoperability across African countries. He said that this could empower the underserved populations with essential financial tools to help unlock opportunities for savings, loans, and secure transactions, as well as promote economic stability and growth.

He cited a McKinsey & Co. Report on The Future of Payments in Africa (2022), which stated that Africa’s e-payments industry generated approximately US$24 billion in revenues in 2020, of which about US$15 billion was domestic electronic payments. He said that this implies that e-payments have the potential to be a major growth pole for Africa, especially as the convenience and scalability of payment methods improve and the supportive infrastructure develops.

He said that mobile money interoperability remains a critical payment market infrastructure, which can boost cross-border payments on the continent. He said that Africa’s long-standing strategic objective has been regional integration and that various initiatives have been pursued by existing regional blocs to offer interoperable payment systems to facilitate trade. However, he said that market fragmentation persists with a range of non-tariff barriers that increase the cost of transactions and limit cross-border trade.

He said that Africa’s cross-border payment infrastructure has also not been as developed as the national payment infrastructures. He said that most African countries have fairly developed domestic payment infrastructure such as Real Time Gross Settlement Systems, National Switches, and Cheque Codeline transaction Systems.

He concluded by expressing his confidence that the panel discussion would provide and powerfully shape the trajectory of mobile interoperability, influence policymaking, and inspire the development of solutions that transcend boundaries – not only for financial inclusion but also to promote intra-Africa trade and therefore growth and poverty reduction.

Source: Kofi Otuo Bekoe