The Bank of Ghana (BoG) has reiterated its commitment to address major gaps in the financial ecosystem of the country.

This is to ensure the country does not return to the EU and UK’s list of high-risk money laundering and terrorism financing countries.

In 2016, a mutual evaluation carried out identified significant deficiencies in Ghana’s AML/CFT/PF regime, leading to a grey listing by Financial Action Task force (FATF) in 2018 until 2020 when Ghana was de-listed following extensive reforms to strengthen the regime, in line with FATF recommendations.

This was disclosed at the Money Laundering, Terrorism Financing and Proliferation Financing (ML/TF & PF) National Risk Assessment (NRA) pre-assessment workshop in Accra.

It was to prepare the country for the third round of mutual evaluation in 2025.

Second Deputy Governor BoG, Elsie Addo-Awadzie, speaking at the event pledged the central bank’s willingness to tighten the country’s regulatory framework to combat money laundering and terrorism financing.

She said, “it is imperative that we sustain the fruits of the hard work exerted by all stakeholders that led to critical reforms and implementation that persuaded FATF, the EU, and the UK to remove Ghana from any adverse listings for ML/CFT/PF risks. All stakeholders must continue to work to maintain an effective AML/CFT/PF regime that stands the test of time.”

For her, the NRA allows for a self-assessment on whether Ghana’s AML/CFT/PF regime is still robust in the face of recent developments at a time financial systems, key sectors, and business practices have evolved.

“The Bank of Ghana, as the guardian of the monetary system, remains committed to playing its parting as regulator to support the successful completion of the NRA and a successful Third Round Mutual Evaluation exercise. Starting in January this year, the Bank of Ghana is sensitizing banks and other regulated entities on what is required from them to make the NRA a success. I know that other regulators in the financial sector and in relevant sectors are doing likewise”, Elsie Addo-Awadzie added.

The Financial Intelligence Center said it will work to mitigate these systemic issues confronting the country to make Ghana a destination of financial services on the continent.

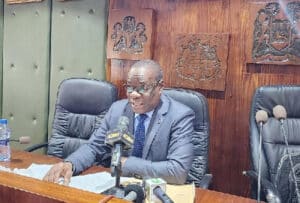

“We will properly channel resources to mitigate the risks identified in our continuous efforts to strengthen our regime. We are being asked to roll up our sleeves and get to work again. I have no doubt in my mind that with your support we can do it again. We will do it again to maintain the good image of Ghana in the sub-region as far as AML/CFT is concerned”, said CEO of the Financial Intelligence Centre, Kwaku Dua.